Is It Possible To Switch From One Mutual Fund To Another?

Often, investors wish to switch from one mutual fund to another. Sometimes, they want to exit from the current mutual fund and other times, they find a second option to be more favourable. Switching from one mutual fund to another is definitely possible within the same fund house. When you decide to do this, you move your entire investment or a part of it from one mutual fund scheme to another.

However, you can also switch mutual fund houses. This is called switch in, switch out, which allows you to switch from one mutual fund house to another. When you do this, you can redeem units from your fund source and purchase units in the fund target after switching.

Switching within the same fund house

To switch mutual fund schemes in the same fund house, you need to fill out a switch form. In this form, you specify the amount or the number of mutual fund units you wish to switch and transfer to another scheme. You select the source scheme and name of the destination scheme where you want the switching to take place. As an investor, you must fulfil the minimum investment criteria for both the switch in and switch out mutual schemes. The fund house can imply some exit loads and capacity gain taxes while you switch. Do not worry about the settlement period, as your money stays within the same fund house.

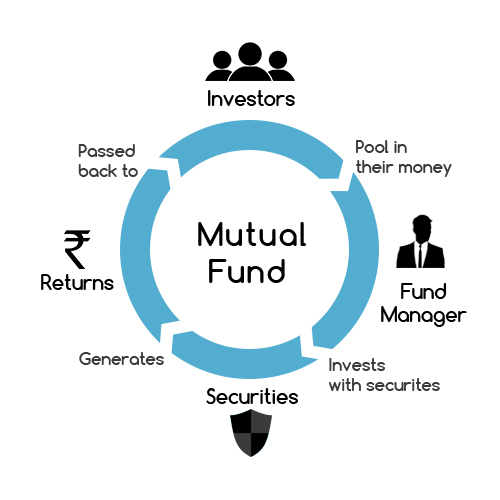

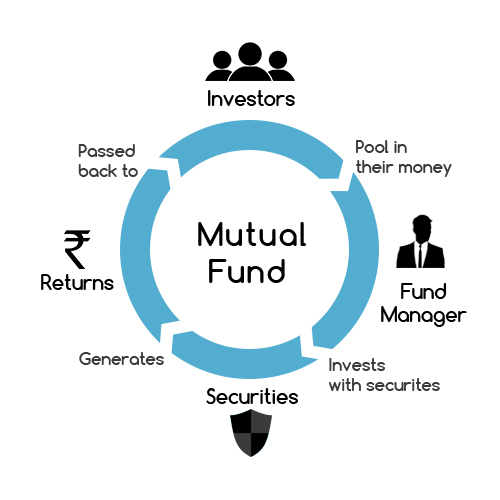

How does switching work?

Let us understand the switching process through an example. Let us consider that you wish to switch from a mutual fund scheme A to a mutual fund scheme B. In this situation, it is almost like you sell investments from one fund and reinvest them to another, selling funds from A in order to reinvest in B. You can also redeem from the mutual fund scheme A and wait till the redemption process takes place and you receive the proceeds straight in your bank account. Here is when exit loads and tax implications are taken into consideration. Next, you fill the application form for mutual fund B, where you want to reinvest the proceeds after receiving the credit from mutual fund A. And it is done!

How to decide whether it is time for you to switch mutual fund?

The circumstances when you can consider switching mutual funds are –

- The current mutual fund scheme giving a low performance

- Change in your investor objective and long-term goals

- A desire to handle the mutual fund schemes by yourself

- A willingness to witness a difference in the portfolio

- The high performance of some other mutual fund scheme

However, you must analyze if your switching concerns are really valid before getting into the switching process. If you have a long-term investment, say for over ten years, you can consider switching from a regular plan to a direct plan. If there is a significant difference in the return on investment (ROI) between the direct and regular plans for the given time period, the decision to switch seems logical.

Before moving forward with switching the mutual fund schemes, here are a few things that are imperative for you to know –

- Since direct funds have a more significant net asset value, they require in-depth market knowledge and analysis. You must be in touch with the market and know how to study detailed trends. Tracking the portfolio comes under your responsibility as well. Hence, you must know how to take care of the funds independently.

- Exit loads are percentage value charges when you redeem funds before their investment period is completed. They are between 0-2% and need to be paid by you.

- When you switch equity funds before a year of their investment, it results in 15% tax on capital gains. If you switch after a year of the investment, it becomes tax-free. Debt-oriented funds have such specific rules as well. It would be best if you went through all the tax laws before making a switching decision.

- Devise an asset allocation strategy and choose a suitable fund that allows you to diversity your portfolio. Analyze the fund’s performance in the past years before you execute the switching procedure.

Conclusion

The article covers what mutual fund switching means and how you can proceed to do the same and under what circumstances. It mainly covers the switching from regular to direct plans that benefit you in the long term. It also saves you commission costs of having a financial advisor on board, since here you manage everything yourself. To do the same, you must have the required market and fund knowledge to handle all due diligence and documentation yourself.