Thematic Investing

The popularity of thematic investing has been increasing over time due to its capabilities of creating an extensively high-powered portfolio that helps you leverage a particular asset theme. There exist various sustainable themes that are actually able to outperform traditionally available assets in the world of investing and trading. It is also easier as it contains a smaller list of assets that you can invest in, so it helps you cut down on research time and takes the confusion away.

What is thematic investing?

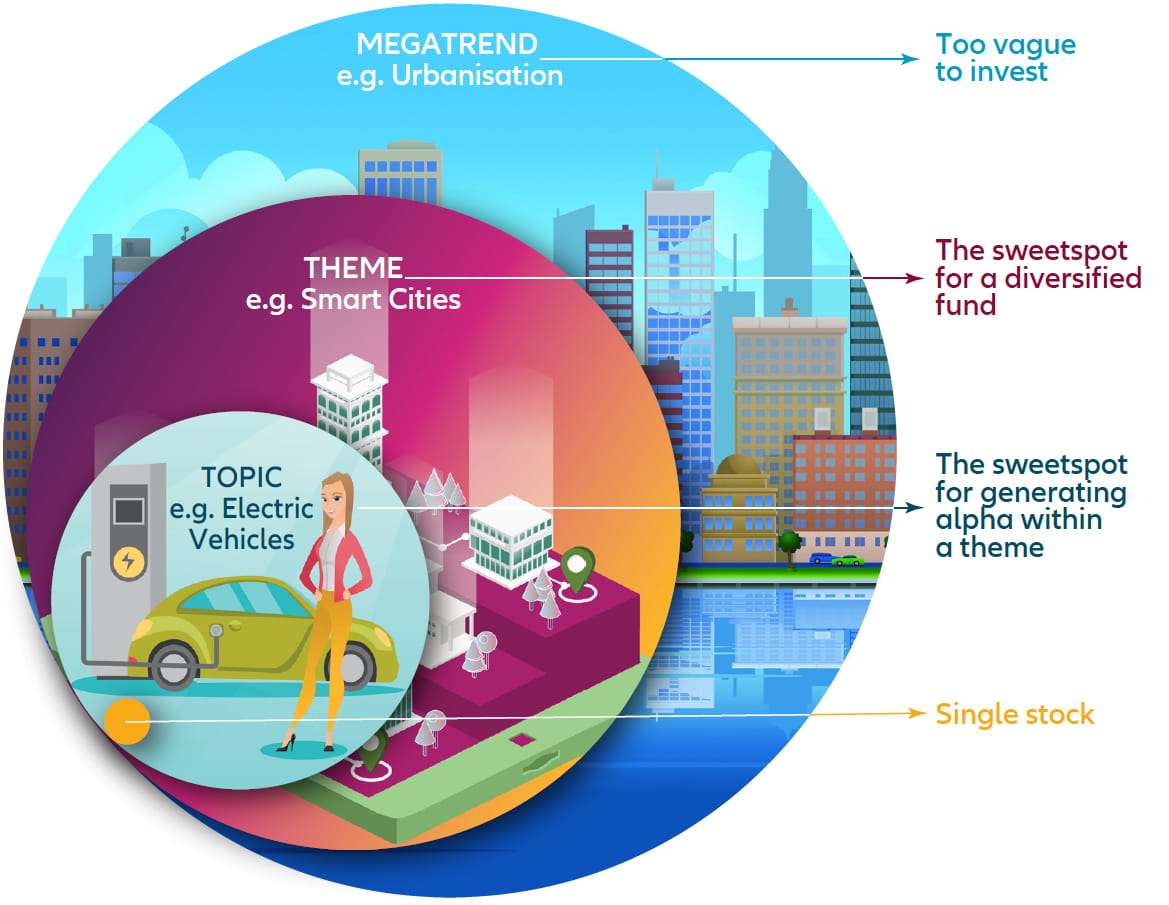

Thematic investing is an investment form that identifies various macro-level trends and invests in assets that benefit from such trends. It includes stocks that have benefitted from particular trends in the global economy like cloud computing, solar energy, drones, and more. It is basically like investing in stocks/companies that belong to the same theme.

Building a portfolio based on themes vs. building a portfolio based on sectors

When investors invest in stocks based on sectors, they can take a diversified approach to investing that mitigates risk and volatility present in the stock market. It also allows them to invest in particular areas that interest them and contain high conviction.

However, investing in stocks belonging to the same theme is a much broader concept when compared to a sector. Such investment encompasses major social trends like global warming, the standard of living, and other related things. Hence, investors need to find which stocks in thematic investing fit the thematic trend and outperform non-thematic stocks.

Portfolios that are based on sectors rotate quite a few times during a particular cycle, especially when an economy moves from a cyclical recovery to a sustainable economic expansion, leading to overheating and recession, then bouncing back to its initial position. It is essential for navigating through such sectoral peaks critically in order to make wise investment decisions.

On the other hand, portfolios based on themes cover ideas that were launched to exist for at least 5 to 10 years in the economy. They go through different economic cycle phases and seek long-term existence and outcomes for the investor.

Focus on the companies while building your thematic investment portfolio

The key to building a profitable thematic portfolio is focusing more on the companies than just identifying the themes. Select individual companies that directly and indirectly benefit from an existing theme to start building your thematic portfolio.

Often, when a theme is identified, it outlives its usefulness. At times, it morphs into something else like globalization turning into an actual robotics economy because imports get replaced by automatic factories in the future.

Let us consider the COVID 19 pandemic as a phase for building a thematic investment portfolio. It was researched that the online shopping space, healthcare, and communications system were the best trends in which an investor could lock their money. Similarly, the post coronavirus vaccine period witnessed sectors like banks, energy, and similar industry sectors taking a rise. Long-term themes like battery value chain and cyber security were also identified to outperform other sectors irrespective of the macroeconomic drop due to the global pandemic.

Thematic investing benefits

- It helps you create a high-powered portfolio that creates significant wealth in the long term. This leads you to have strong profit potential and solid portfolio diversification.

- Most sustainable themes are able to outperform the equity funds and give you greater long-term returns.

- You can fine-tune all your themes based on your risk appetite. For example, you can choose stocks belonging to your theme as per your risk profile, invest in high-risk-high return stocks if you have a large risk appetite, and invest in large-cap stocks if you have a low-risk appetite.

- You can easily leverage a particular theme and benefit from strongly outperforming themes like FMCG, Private banks, IT, and more.

- The power of themes is that it helps you catch big disruptions quite early. This means if you invest a small amount even today, 20 years later, you could get handsome money out of it.

Concluding statement – how can you make thematic investments?

Exchange-traded funds or ETFs are one of the best ways to invest in different themes and create a thematic investments portfolio. It helps you capture ongoing themes and categories to invest in the best of the stocks related to the said themes. For example, suppose you wish to invest in country-specific exchange-traded funds. In that case, you can invest in SPY that is responsible for tracking the entire S&P 500 index in the United States of America. You can also choose other thematic ETFs that invest in specific themes like robotics, AI, fintech, renewable energy, and other such theme-focused stocks.

Want to speak with a finance professional? Request an introduction from us and we can put you in touch with someone who can help you create a thematic investing portfolio.