The UK Budget 2023 stands as a defining moment in the fiscal landscape of post-pandemic Britain, interwoven with the ongoing geopolitical shifts. For British expatriates in the Middle East, the Budget’s implications are multifaceted, influencing everything from pension incomes to investment strategies. This in-depth analysis explores the Budget’s critical elements, including national insurance and the triple lock policy, and their consequential effects on British expats.

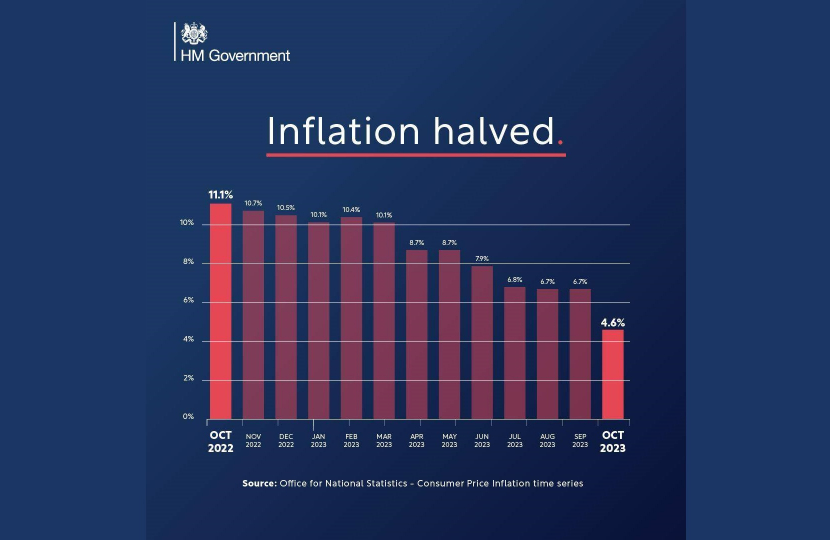

Halving Inflation: A Dual-Edged Sword

Halving Inflation: A Dual-Edged Sword

The UK’s aggressive stance against inflation, marked by initiatives such as the Energy Price Guarantee and the Bank of England’s interest rate hikes, aims to combat the inflation spike to a target of 2.9% by the end of 2023. Expats with UK-based financial interests must brace for these shifts. The fluctuating value of the pound, coupled with variable inflation rates, could significantly alter investment yields and savings. Additionally, for expats considering a return to the UK, they may encounter an economic environment starkly different from their previous experiences, necessitating a re-evaluation of their financial plans.

Inflation and Global Energy Dynamics

The global energy crisis, primarily spurred by geopolitical tensions, has a cascading effect on expatriates. Those owning property or businesses in the UK must navigate the complexities of energy costs, which could influence operational expenses and investment returns. The energy landscape’s unpredictability necessitates a dynamic approach to financial planning, emphasizing the importance of staying informed about both regional and global energy markets.

UK Budget 2023 Growth Strategies and Expats’ Opportunities

The Chancellor’s blueprint for growth, encompassing employment, education, enterprise, and equitable development, presents a dual scenario for expats. On one hand, the enhancement of pension tax relief and business incentives bodes well for those with vested interests in the UK’s financial markets or pension schemes. On the other hand, the push for domestic workforce development and regional investments could constrain opportunities for expats aiming to leverage their international experience in the UK job market.

Expanding Enterprise and Global Competitiveness

The introduction of full expensing for plant and machinery investment for three years, starting from April 2023, signals a robust pro-business stance. This move, aimed at spurring immediate corporate investment, could benefit expats running or planning to establish businesses in the UK. However, the long-term implications of these policies on global competitiveness and market dynamics warrant careful analysis, especially for those managing cross-border operations.

National Insurance Adjustments: A Closer Look

Alterations in national insurance rates and policies could directly influence expats, particularly those maintaining business or employment ties within the UK. Changes in taxation and insurance policies necessitate a recalibration of financial strategies for expats, ensuring that their contributions and benefits align with the new regulations. For those drawing pensions or planning retirement, understanding the nuances of these changes is paramount.

Alterations in national insurance rates and policies could directly influence expats, particularly those maintaining business or employment ties within the UK. Changes in taxation and insurance policies necessitate a recalibration of financial strategies for expats, ensuring that their contributions and benefits align with the new regulations. For those drawing pensions or planning retirement, understanding the nuances of these changes is paramount.

Understanding the Fiscal Implications

The adjustments in national insurance also have broader implications on the UK’s social welfare system, potentially affecting public healthcare benefits and state support mechanisms. Expats with familial or personal ties to these systems must consider the changes’ impact on their long-term financial and health security.

The Triple Lock Policy: Security for Pensioners

The steadfast commitment to the triple lock policy is a boon for retired expats in the Middle East. It assures that state pensions will rise in line with inflation, average earnings growth, or a minimum of 2.5%, whichever is higher. This policy is a critical safeguard, ensuring that pensions for expats do not erode in real terms, providing a semblance of financial stability in an otherwise fluctuating economic environment.

Pension Planning in an Inflationary Context

With inflation being a central concern, the triple lock policy’s relevance is further accentuated. It ensures that expat pensioners can maintain their purchasing power and manage the cost-of-living adjustments more effectively. This becomes particularly crucial for those who rely heavily on their UK pensions for their livelihood in the Middle East.

Public Debt and Economic Stability

The UK’s burgeoning public debt, nearly £2.5 trillion, poses significant questions about long-term economic stability and fiscal responsibility. For expats, especially those in financial sectors, these developments are not just macroeconomic indicators but critical factors that could influence investment decisions, risk assessments, and even currency stability.

The UK’s burgeoning public debt, nearly £2.5 trillion, poses significant questions about long-term economic stability and fiscal responsibility. For expats, especially those in financial sectors, these developments are not just macroeconomic indicators but critical factors that could influence investment decisions, risk assessments, and even currency stability.

Navigating Economic Uncertainty

The management of public debt and the government’s fiscal policies are key indicators of economic health. Expats must remain vigilant about these developments, as they could have far-reaching consequences on global market confidence and the UK’s economic standing. This is especially pertinent for expats working in finance, investment, and economic planning sectors.

Conclusion: Navigating the New Landscape

The UK Budget 2023 sets forth a transformative path, directly and indirectly impacting British expats in the Middle East. In this evolving financial ecosystem, staying informed and adaptable is crucial. By understanding these changes and adjusting strategies accordingly, expats can effectively navigate the complexities and opportunities presented by the UK Budget 2023.

Frequently Asked Questions: UK Budget 2023 and British Expats in the Middle East

Q1: How does the UK Budget 2023 impact British expats in the Middle East? A1: The UK Budget 2023 has several implications for British expats, especially in terms of inflation management, pension policy (including the triple lock), national insurance changes, and broader economic strategies. These changes can affect expats’ financial planning, investments, and pension income.

Q2: What is the triple lock policy, and why is it important for expats? A2: The triple lock policy guarantees that the UK state pension increases annually by the highest of three measures: inflation, average earnings growth, or 2.5%. For expats, particularly retirees in the Middle East, this policy ensures that their UK pension income keeps pace with the cost of living and inflation.

Q3: Are there any changes to national insurance that affect expats? A3: Changes to national insurance rates and policies in the UK Budget 2023 could impact expats who maintain economic ties with the UK, such as business interests or employment. It’s important for expats to review these changes for any potential effects on their financial planning.

Q4: What does the UK Budget 2023 say about inflation, and how might this affect expats? A4: The Budget addresses high inflation, with measures to reduce it to a target of 2.9% by the end of 2023. For expats, this could influence the value of UK-based investments and savings, as well as impact those considering returning to the UK.

Q5: How does the UK’s approach to public debt in the Budget impact expats in the Middle East? A5: The UK’s management of its significant public debt, almost £2.5 trillion, can affect global economic perceptions and stability. Expats, particularly those in financial sectors, should consider these factors in their investment decisions and risk assessments.

If you want to speak with an expat financial expert, click the link below to request and introduction.